57

production and a mild start to the

2014-15 winter season. By the end of

February 2015, storage was about

500bcf higher than the same time in

2014, but about 140bcf below the

five-year average.

What do these numbers mean for

energy pricing? Storage should be in

pretty good shape heading into the

summer 2015. But the question will

be how hot the weather will get. A

very hot summer will mean more gas

being used at electric power plants,

which will reduce the amount of gas

going into storage.

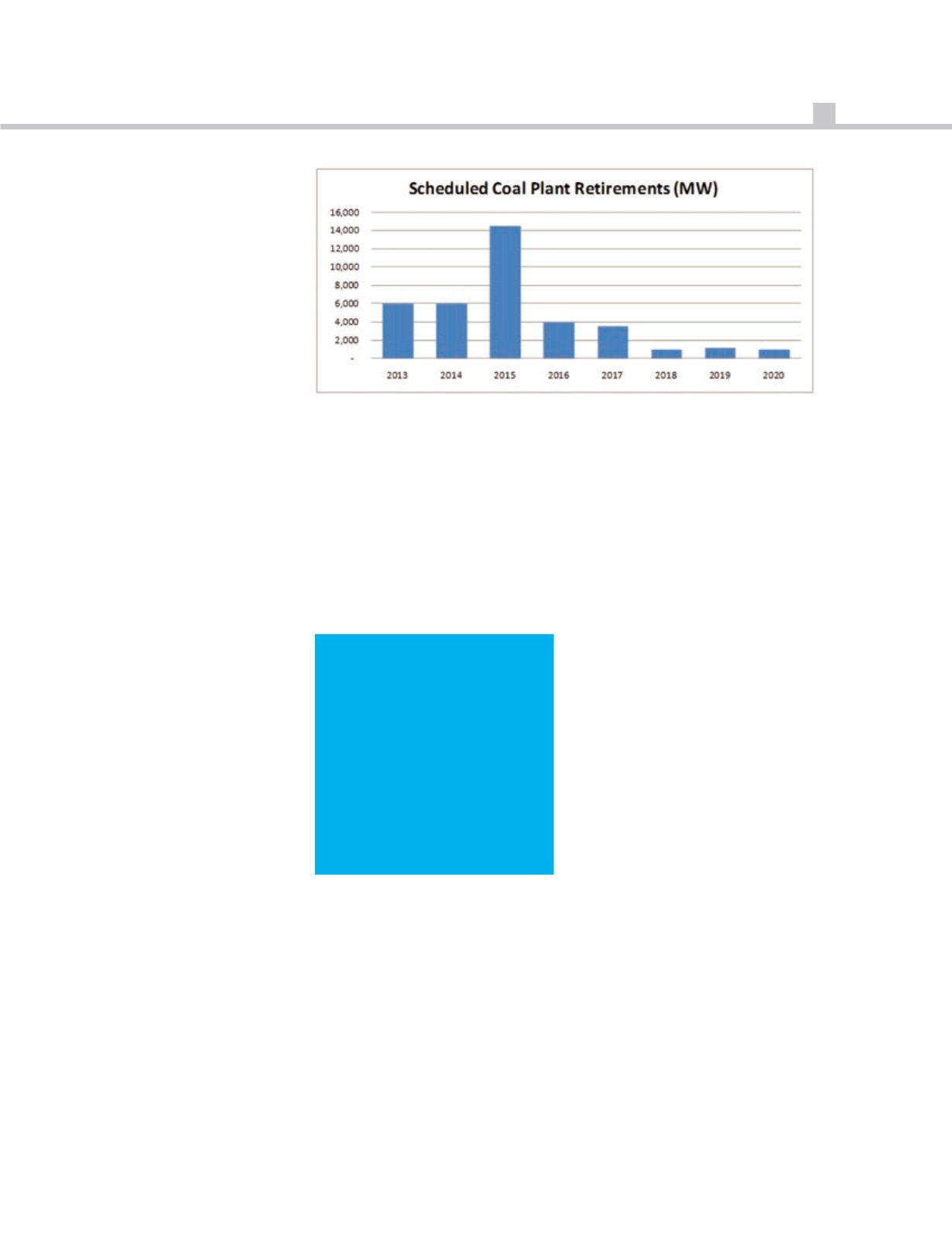

2. Retirement of Coal-Fired Power

Plants:

Natural gas generation of

electricity continues to grow as coal-

fired power plants are retired. This

has created a permanent increase in

demand for natural gas. A few key

statistics are:

• Natural gas has become the fuel

of choice for electric generation,

especially as new EPA standards

impact 1,400 coal and oil units.

• Scheduled coal plant retirements

between 2013 and 2020 will result

in increased natural gas

generation.

• Approximately one-third of

electricity in the U.S. is generated

using natural gas. Another one-

third is coal and the last one-third

is comprised of all other (nuclear,

renewable, etc.).

As coal-fired power plants are

retired, the increased base load

natural gas demand for electric

generation will increase price

sensitivity.

3. Natural Gas Exporting (Liquid

Natural Gas):

In 2015-2016, large

energy companies will begin

exporting natural gas to Asia and

Europe where they can achieve prices

roughly triple the price in the U.S.

This will cause a longer term change

to the supply-demand balance. It will

also begin what could be a transition

from a North American natural gas

market to a global natural gas market

(similar to oil).

WHERE DO PRICES

GO FROM HERE?

Natural gas and electric prices are at

very attractive levels and are not far

off from a 10-year low. How long

prices will stay here remains to be

seen. Weather will certainly be a

driver in the short term. Longer term,

we see demand for natural gas

increasing due to coal plant

retirements and increased natural

gas exports. This increased demand

will put upward pressure on both

natural gas and electric prices. At

these current levels, customers

should give serious consideration to

locking into a longer term deal.

PROACTIVE

MANAGEMENT IN

AN UNPREDICTABLE

MARKET

Energy procurement should not be

an annual task, or something

reviewed just prior to the expiration

of a supply contract. This is an

ongoing process which, if managed

correctly, can lead to positive bottom

line results despite the extremely

volatile market.

There are two important strategies

that can be employed when

structuring an energy supply

agreement to limit exposure to price

run-ups or spikes:

1. A Fixed Price Agreement:

This is

a common strategy that provides a

customer with price and budget

certainty. In this case, usage

becomes the only variable that

needs to be monitored and

managed.

WWW.7X24EXCHANGE.ORGWorldwide Natural Gas Prices

– Snapshot as of June 2014:

• United States: $3.80 /dth

• Europe: $7.80 /dth

• Asia: $14.00 /dth

• South America: $15.00 /dth