58

2. A “Block and Index” Structure:

Here, a customer can fix all or a

portion of the price. The pricing can

be locked in blocks or percentage

levels at different times. While this

requires more management and

oversight, it allows a company to

dollar-cost-average their price,

similar to what an investor would do

with a stock purchase.

Given the energy factors discussed

above and current market pricing for

electric and natural gas, we could be

faced with rising rates in the future.

As a result, businesses need to look

at the importance of proactively

managing their energy procurement

now in order to reduce the potential

negative exposure that could be

coming down the road.

7X24 MAGAZINE SPRING 2015

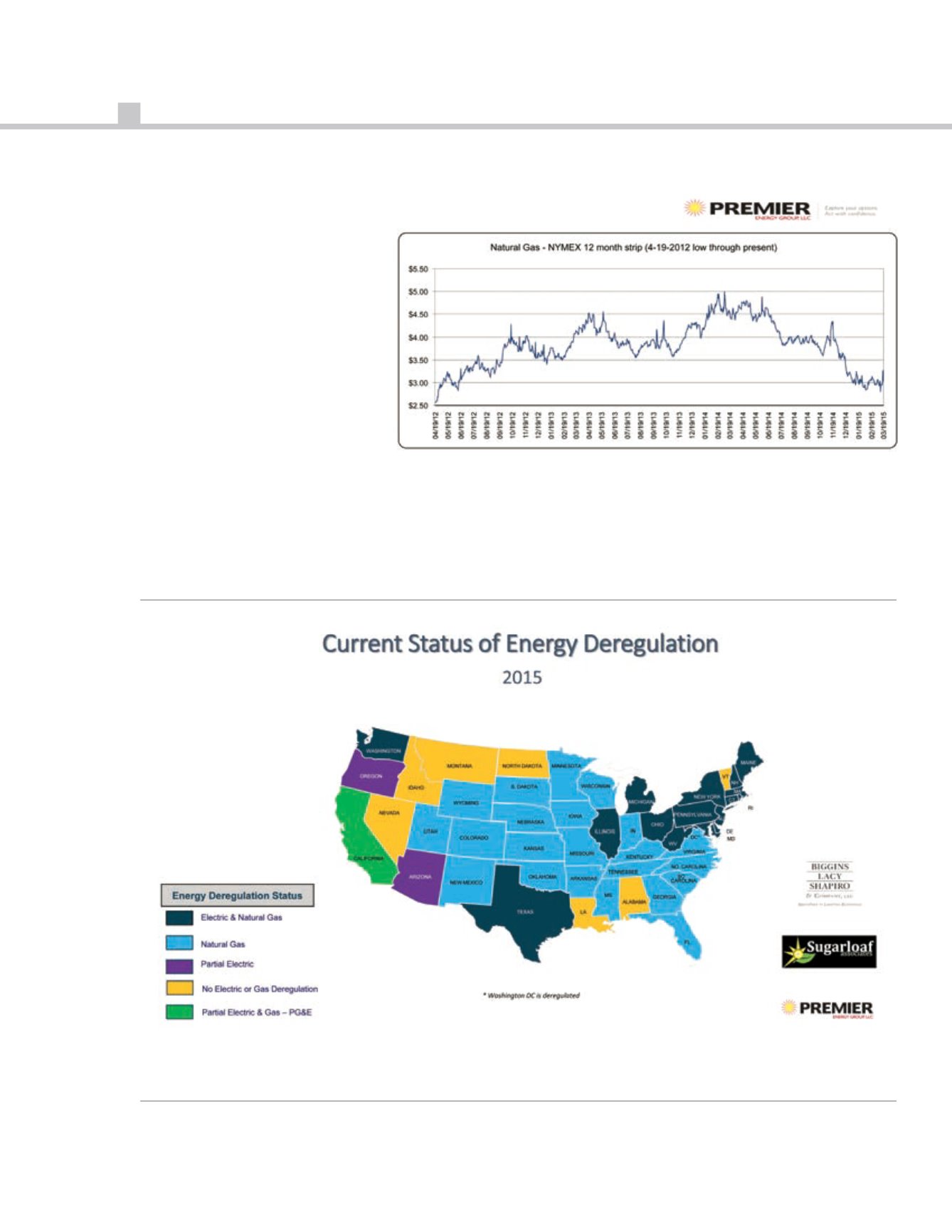

Graphic 2 – Map of Deregulated Markets (PPT slide)

Graphic 1 - Natural Gas Price Trends

This graph shows the 12-month average future price trend for natural gas since April

2012. After reaching a 10-year low in April 2012, natural gas prices moved significantly

higher over the next two years. Prices have since dropped and are now just slightly

above the low reached in 2012.

Tim Comerford is the SVP of Biggins Lacy Shapiro’s Energy Services group and principal of Sugarloaf Associates.

He can be reached at

[email protected]Joe Santo is the Principal and Director of Business Development at Premier Energy Group, LLC. He can be reached at

[email protected]